Feb 13, 2026

iGaming KYC: Balancing Risk, Compliance, and Player Experience

iGaming KYC: Balancing Risk, Compliance, and Player Experience

iGaming KYC: Balancing Risk, Compliance, and Player Experience

KYC-driven identity verification is a core element for fraud prevention in iGaming. It helps these platforms establish trust at onboarding by creating a secure, fair, and sustainable ecosystem, preventing abuse, preserving integrity of the platform, and ensuring regulatory compliance.

Author

Team Bureau

TABLE OF CONTENTS

See Less

Powered by rising smartphone and internet penetration, expanding digital payment rails, growing consumer interest in sports betting, and legalization across regions, the global iGaming market continues to scale. From $91.63 billion in 2025, the market is expected to expand to $101.45 billion in 2026. This expansion, however, is not just scaling revenue, it is also widening the attack surface. As transaction velocity and onboarding volumes increase, platforms are finding it harder to manage evolving risks from suspicious payments and synthetic, stolen, or manipulated identities.

The touchpoints most vulnerable to fraud are usually the deposit and withdrawal stages, where most of the money is involved.

As a result, KYC verification at the onboarding stage has become a mandatory check. Effective player identity checks can help gaming platforms proactively detect suspicious behavior, reduce bonus abuse, and ensure payouts are distributed to legitimate players.

To prevent fraud and abuse early in the tracks without disrupting user experience, the iGaming industry is shifting from manual, document-heavy reviews to using automated, intelligence-led verification. These modern identity verification solutions combine identity data, behavioral signals, and risk scoring to deliver faster decisions, augment fraud detection, and a smoother player experience at scale.

Related Read: What Is KYC?

Understanding financial crime risk in online gaming

Fraudsters target online gaming platforms for three key reasons: money movement is swift, platforms operate globally, and volumes of smaller transactions are higher. Therefore, fraudsters primarily exploit gaming platforms to launder illicit funds, abuse promotional bonuses, and scale multi-accounting operations.

Related Read: What Is Promo Abuse and How It Quietly Kills Unit Economics

These patterns exhibit two distinct, yet closely linked, risks in online gaming: transactional risk and identity risk. Transactional risk focuses on suspicious payment behavior, while identity risk centers on who the player actually is. Although both the risk types need attention, it is the identity risk that most often scales transactional abuse.

Risk type | How it works | Example |

Transactional risk | Deposits, withdrawals, chargebacks, unusual payment frequency. | A player deposits $5,000 via stolen cards and cashes out quickly. |

Identity risk | Fake IDs, synthetic identities, multi-accounting | One fraud ring creates 120 accounts to abuse and cash out welcome bonuses. |

In view of escalating abuse and fraud types that are identical to what fintechs often face, regulators have started treating gaming platforms like financial institutions. They are increasingly enforcing AML controls, customer due diligence, and ongoing monitoring standards for the gaming industry as well. Failure to comply can lead to penal and legal action such as in the case of Australian regulators suing a gaming platform for AML breaches.

This approach to treat gaming platforms on par with financial institutions is ideal when it helps reduce financial crime and strengthens platform trust. However, it can backfire when rules become overly rigid, creating friction for legitimate players without meaningfully reducing real fraud risk.

From compulsion to competitive advantage: The evolution of compliance in iGaming

For the iGaming industry, compliance has evolved from an inconvenient hassle to becoming a growth lever. Here is why.

Well-designed KYC reduces friction for legitimate players, hastens withdrawals, and reduces false declines.

Also, when identity checks are accurate and risk-based, players experience fewer interruptions, which fosters confidence in the platform.

On the other hand, weak compliance erodes brand trust, increases player churn, and shrinks lifetime value. Further, gaming platforms also face the risk of hefty fines, license suspensions, and in the worst-case scenarios, getting barred from the market.

In short, gaming platforms that have strong KYC, AML controls, and audit-readiness can onboard new players, payment providers, and attract partners more easily.

Related Read: Global KYC and AML Regulations: Part 1 - What Regulators Really Expect

How iGaming platforms meet regulatory expectations in practice

In practice, strong compliance goes beyond ticking boxes, and takes the form of running a disciplined, risk-averse operation. To run such an operation, compliant iGaming platforms avoid blanket verification and, instead, adopt risk-based onboarding.

Risk-based onboarding vs blanket verification

Risk-based onboarding refers to identifying low-risk players based on markers like geography, payment methods, behavior, and device signals. They are instantly approved with minimal friction, since their risk presets have been found to be safe.

Higher-risk users, who exhibit risky behavior based on the same markers, are subject to deeper checks. These include, and are not restricted to, document verification, source-of-funds scrutiny, or enhanced due diligence. This approach aligns with regulatory expectations while protecting conversion rates and player experience.

Ongoing monitoring vs one-time checks

Modern compliance also treats KYC as a continuous control, not a one-time gate. It is a known fact that fraud evolves over time, based on several factors. As a result, platforms deploy ongoing monitoring to trigger step-up verification, re-screen users, and flag suspicious activity in real-time. This lifecycle-based model is far more effective than one-time checks that are usually executed only at the signup stage.

Reporting, audits, and regulator interactions

Finally, regulatory readiness depends on strong reporting, auditability, and regulator engagement. Compliant-mature operators know how to maintain audit trails, decision logs, and case documentation.

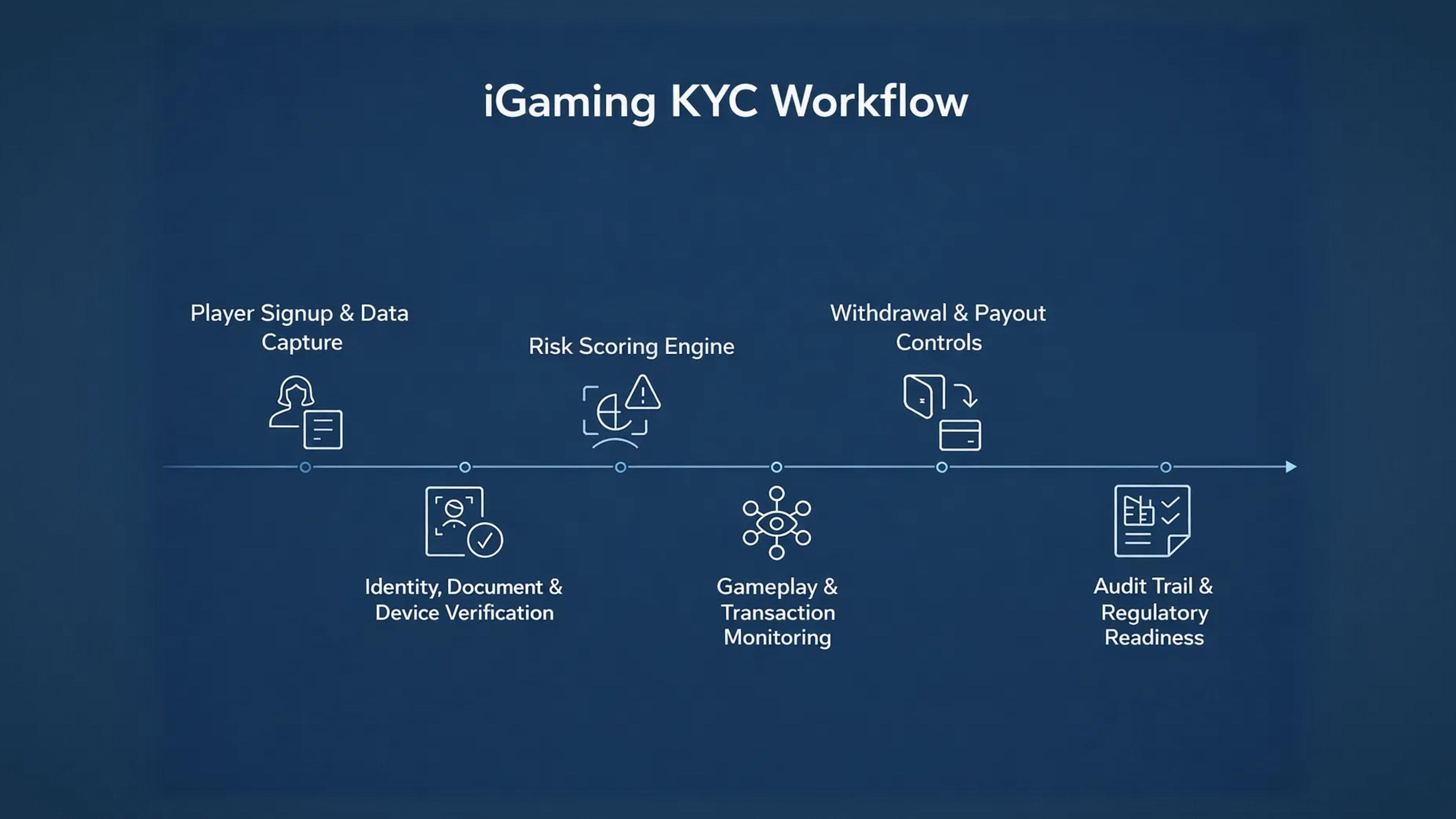

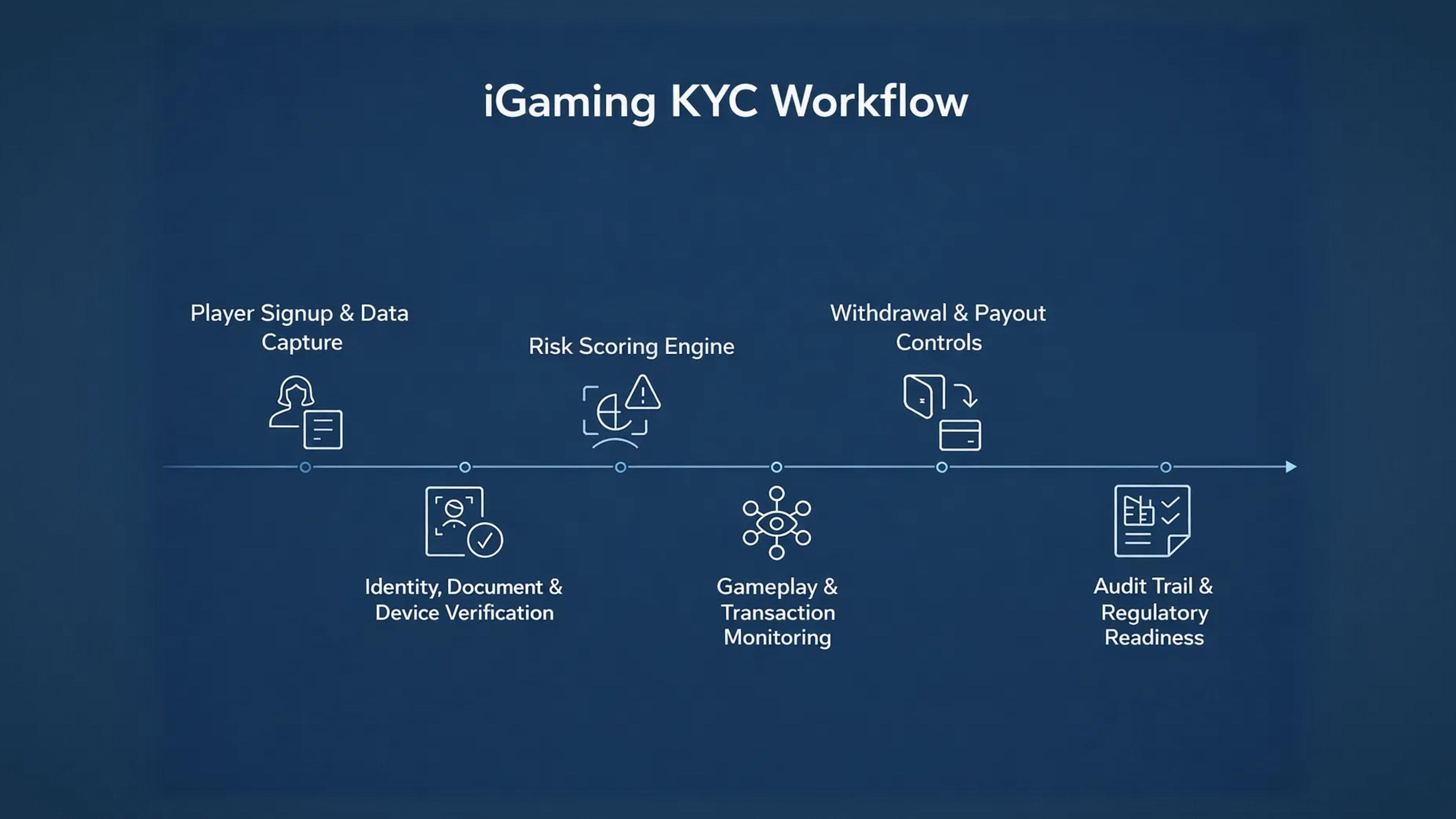

The iGaming KYC workflow

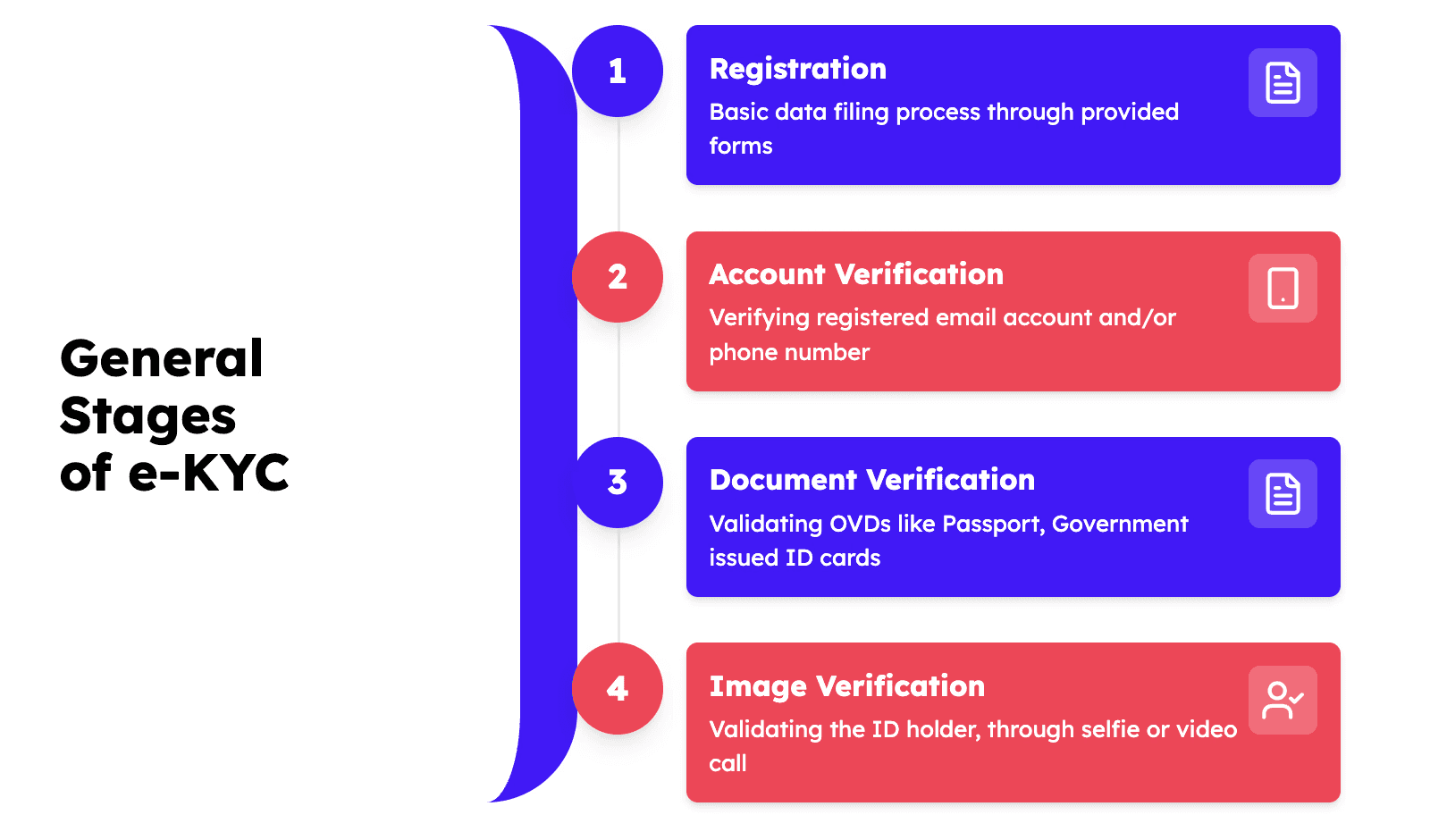

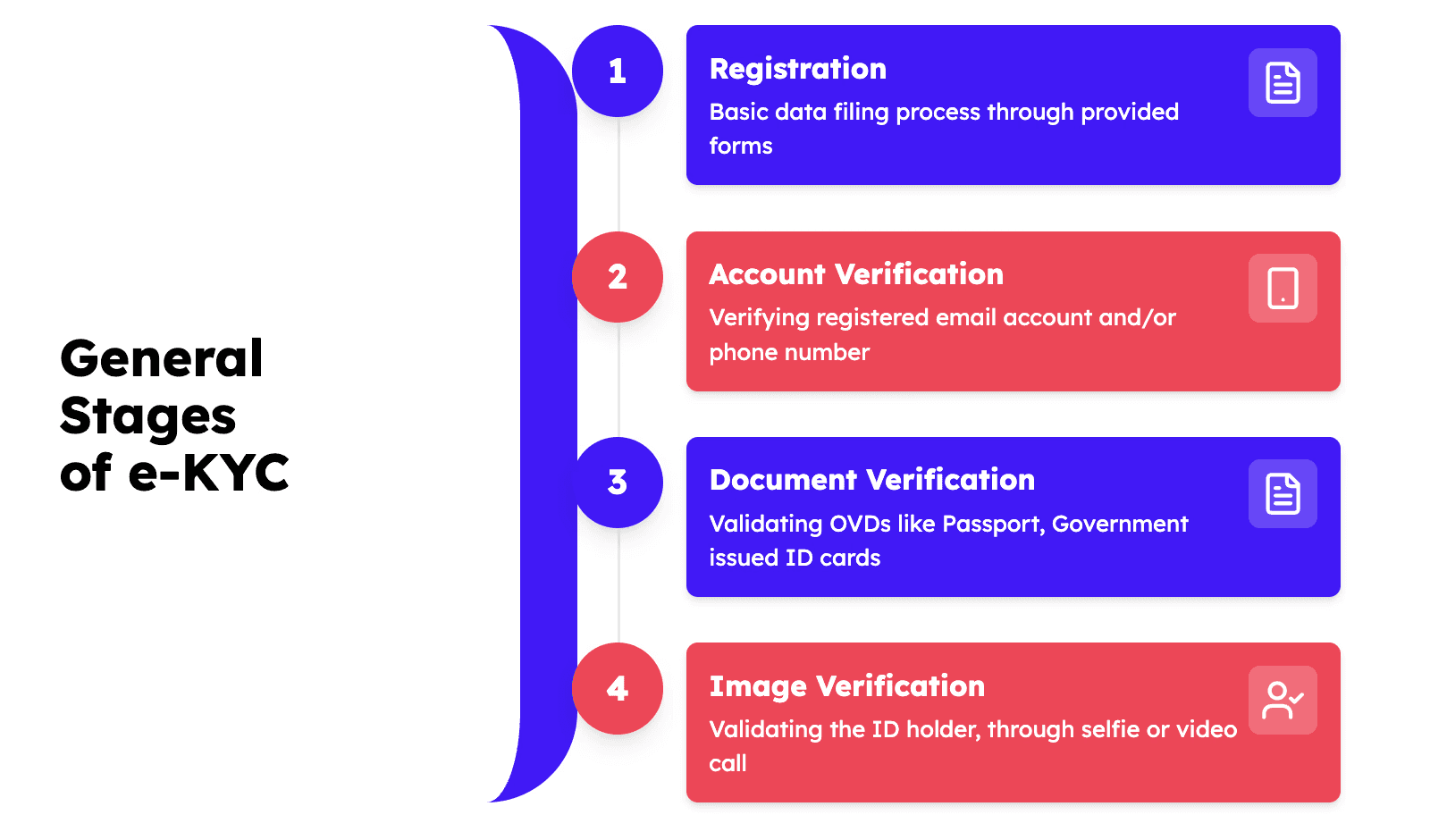

KYC verification in iGaming platforms has a linear process. It begins with the player data capture for verification. The data captured is analyzed for risk signals and continues throughout the gameplay and withdrawal stages. All the transaction logs during these stages are recorded to maintain audit trail and to ensure regulatory compliance.

Player verification: The physical vs digital contrast

Player verification in the real-world casinos is easier since it can be vouched with physical presence and rarely has human oversight. Identity checks are also carried out at entry gates, cash desks, or dedicated VIP counters, as the case may be. Security staff verify government-issued IDs and continue to monitor player behavior and intervene when needed.

Digital casinos operate in a different way. Since digital casinos allow players to join remotely, manual, human-led verification is impractical. There is a need for technical controls that can confirm identity, detect fraud, and prevent multi-accounting. These controls should prevent the player from committing any financial crime and also ensure that money does not leave the platform.

It is here that device intelligence and behavioral signals prove beneficial. Device fingerprinting, IP reputation, geolocation consistency, session behavior, betting velocity, and gameplay anomalies also help in identifying real players from fake profiles and bots.

Related Read: How Device Intelligence Adapts to Global Data Sovereignty

Designing KYC for online casinos without interrupting player experience

Effective KYC in iGaming is about minimizing friction without weakening controls. It may not be possible and practical to verify every single player. However, progressive verification models can be introduced that have light checks and introduce deeper verification only as risk or value increases.

Instead of blocking players with rigid rules, gaming platforms can rely on smart triggers like unusual betting patterns, rapid deposits, bonus exploitation, or location changes. This replaces disruptive “hard stops” with targeted, timely checks.

How to retain high-value players while enforcing strong controls

As mentioned before, a disciplined approach to risk management can help enforce strong controls while retaining players. Leading gaming platforms do this by segmenting players according to risk level, geography, spend, and behavioral patterns. Revenue is also taken into account, but as a secondary signal following these primary signals.

Further, for returning players, trust-based journeys reduce unnecessary friction. Platforms can re-use prior verification data, recognize trusted devices, and apply lighter re-checks unless risk signals change.

Clear, proper communication can also prevent churn and help retain players. Giving context about the checks in place, setting expectations on timelines, and offering real-time status updates helps prevent player frustration and keeps them engaged with the platform.

Related Read: The Next Frontier of Fraud Risk Management: From Reactive Defense to Predictive Trust

Around the world: Regulatory landscape for iGaming KYC

Below is a high-level view of how KYC and AML expectations vary across key iGaming regions and how they impact gaming platforms.

Region | Regulatory maturity | Key KYC / AML requirements | Operational impact on iGaming |

Southeast Asia | Fragmented, evolving | Country-specific licensing (e.g., Philippines PAGCOR), player identity verification, AML screening, payment monitoring | Operators must localize KYC flows by country, manage uneven enforcement, and prepare for future regulatory tightening |

Middle East | Early-stage, restrictive | Strong identity verification, strict payment controls, financial transparency, conservative risk thresholds | Expect slower onboarding, enhanced payment due diligence, and higher compliance friction |

European Union (EU) | Mature, multi-layered | GDPR (data protection), AMLD (AML/CFT), national gaming authority oversight, risk-based KYC, ongoing monitoring | Requires robust data governance, explainable risk decisions, localized regulatory logic, and scalable reporting |

United Kingdom (UK) | Highly mature, strict | UKGC KYC & AML rules, identity verification at onboarding, affordability & financial vulnerability checks, continuous monitoring | Operators must support real-time spend monitoring, affordability triggers, strong audit trails, or risk fines and license action |

Strategic takeaway

Across regions, iGaming is getting regulated in a similar way to how financial services are regulated. The resemblance in operational workflows, volume, variety, and velocity of transactions all contribute to this similar treatment.

Operators that build flexible, region-aware KYC processes and regulator-ready reporting can gain faster market entry, experience fewer disruptions, and enjoy long-term growth.

How to build a future-proof KYC strategy for gaming platforms

Automation, intelligence, and adaptability

Future-ready iGaming operators treat KYC as a strategic capability, not a compliance cost center. The foundation for such a strategic capability is automation, intelligence, and adaptability, as explained below:

Automation helps scale repetitive transactions at higher volumes. It also reduces time required for manual reviews while accelerating player approvals.

Intelligence enabled by artificial intelligence, machine learning, behavioral analytics, and device fingerprinting, helps take faster, more accurate decisions.

Adaptability ensures KYC workflows can evolve quickly as fraud patterns, regulations, and market conditions change.

Partnering vs building internally

There are two ways of enabling a fraud detection and prevention system. Platforms can either choose to partner with an existing system or build one internally.

Building in-house offers control and customization but requires heavy investment in tech stack and its maintenance. Whereas, partnering with a specialized KYC and fraud provider ensures faster deployment, global coverage, and jurisdiction-specific regulatory compliance. Partnering is also known to lower the total cost of ownership, compared to building inhouse.

For most operators, a hybrid model could work best, where the core risk logic stays in-house and is augmented by external intelligence and verification services.

Related Read: From In-House Tools to Unified Fraud Intelligence

Preparing for evolving fraud tactics and regulatory change

Fraudsters use AI and bot-driven attachments to adapt quickly to changing market scenarios and scale up the attacks. Fraud resilience, therefore, depends on preparing for these evolving fraud tactics and regulatory changes.

A future-proof strategy should include rigorous model tuning, regulator-ready audit trails, and cross-functional governance between fraud, compliance, payments, and product teams.

Best practices to stay ahead of compliance and risk management

There is no single checklist that can help any gaming platform stay ahead of compliance and risk management. But, there are certain best practices that can deliver the same result.

To begin with, audit readiness and documentation should be continuous, not reactive.

Gaming platforms must maintain clear KYC decision logs, case histories, source-of-funds records, to smoothen the audit processes, as auditors specifically look for traceability and explainability of risks. Further, they also want to see that the platform follows well-defined retention policies and versioned control frameworks to mitigate such risks.

Internal training and fraud response playbooks are equally critical. Fraud tactics evolve faster than policies. Even with the best tech stack, traditional methods can become obsolete in a matter of weeks. It is, therefore, necessary to constantly update playbooks so they can address common threats such as bonus abuse, account takeovers, money laundering, and fake identity use.

One challenge that most businesses face across all industries is that of siloed tech stacks.

Technology stack alignment across KYC, payments, and fraud can help prevent fraud blind spots. There should be a proper exchange of risk signals between all the relevant systems. Unified data helps reduce false positives, improve decision accuracy, and enables real-time fraud prevention across the player lifecycle.

How Bureau helps reduce iGaming fraud

Bureau adds an external trust layer to the tech stack to strengthen identity verification and fraud prevention. By validating player identity, credit footprint, and historical risk signals, Bureau helps gaming platforms separate real players from fake or high-risk identities.

Bureau’s key benefits include:

Bot detection to block bots, scripts, and AI agents.

An award-winning Device ID to protect users against device abuse.

Proactive gaming KYC that identifies under-age, self-restricted, and blacklisted players.

Play Smart. Verify Faster. Win Player Trust.Bureau’s unified risk decisioning platform helps gaming platforms scale growth while preventing fraud. |

Powered by rising smartphone and internet penetration, expanding digital payment rails, growing consumer interest in sports betting, and legalization across regions, the global iGaming market continues to scale. From $91.63 billion in 2025, the market is expected to expand to $101.45 billion in 2026. This expansion, however, is not just scaling revenue, it is also widening the attack surface. As transaction velocity and onboarding volumes increase, platforms are finding it harder to manage evolving risks from suspicious payments and synthetic, stolen, or manipulated identities.

The touchpoints most vulnerable to fraud are usually the deposit and withdrawal stages, where most of the money is involved.

As a result, KYC verification at the onboarding stage has become a mandatory check. Effective player identity checks can help gaming platforms proactively detect suspicious behavior, reduce bonus abuse, and ensure payouts are distributed to legitimate players.

To prevent fraud and abuse early in the tracks without disrupting user experience, the iGaming industry is shifting from manual, document-heavy reviews to using automated, intelligence-led verification. These modern identity verification solutions combine identity data, behavioral signals, and risk scoring to deliver faster decisions, augment fraud detection, and a smoother player experience at scale.

Related Read: What Is KYC?

Understanding financial crime risk in online gaming

Fraudsters target online gaming platforms for three key reasons: money movement is swift, platforms operate globally, and volumes of smaller transactions are higher. Therefore, fraudsters primarily exploit gaming platforms to launder illicit funds, abuse promotional bonuses, and scale multi-accounting operations.

Related Read: What Is Promo Abuse and How It Quietly Kills Unit Economics

These patterns exhibit two distinct, yet closely linked, risks in online gaming: transactional risk and identity risk. Transactional risk focuses on suspicious payment behavior, while identity risk centers on who the player actually is. Although both the risk types need attention, it is the identity risk that most often scales transactional abuse.

Risk type | How it works | Example |

Transactional risk | Deposits, withdrawals, chargebacks, unusual payment frequency. | A player deposits $5,000 via stolen cards and cashes out quickly. |

Identity risk | Fake IDs, synthetic identities, multi-accounting | One fraud ring creates 120 accounts to abuse and cash out welcome bonuses. |

In view of escalating abuse and fraud types that are identical to what fintechs often face, regulators have started treating gaming platforms like financial institutions. They are increasingly enforcing AML controls, customer due diligence, and ongoing monitoring standards for the gaming industry as well. Failure to comply can lead to penal and legal action such as in the case of Australian regulators suing a gaming platform for AML breaches.

This approach to treat gaming platforms on par with financial institutions is ideal when it helps reduce financial crime and strengthens platform trust. However, it can backfire when rules become overly rigid, creating friction for legitimate players without meaningfully reducing real fraud risk.

From compulsion to competitive advantage: The evolution of compliance in iGaming

For the iGaming industry, compliance has evolved from an inconvenient hassle to becoming a growth lever. Here is why.

Well-designed KYC reduces friction for legitimate players, hastens withdrawals, and reduces false declines.

Also, when identity checks are accurate and risk-based, players experience fewer interruptions, which fosters confidence in the platform.

On the other hand, weak compliance erodes brand trust, increases player churn, and shrinks lifetime value. Further, gaming platforms also face the risk of hefty fines, license suspensions, and in the worst-case scenarios, getting barred from the market.

In short, gaming platforms that have strong KYC, AML controls, and audit-readiness can onboard new players, payment providers, and attract partners more easily.

Related Read: Global KYC and AML Regulations: Part 1 - What Regulators Really Expect

How iGaming platforms meet regulatory expectations in practice

In practice, strong compliance goes beyond ticking boxes, and takes the form of running a disciplined, risk-averse operation. To run such an operation, compliant iGaming platforms avoid blanket verification and, instead, adopt risk-based onboarding.

Risk-based onboarding vs blanket verification

Risk-based onboarding refers to identifying low-risk players based on markers like geography, payment methods, behavior, and device signals. They are instantly approved with minimal friction, since their risk presets have been found to be safe.

Higher-risk users, who exhibit risky behavior based on the same markers, are subject to deeper checks. These include, and are not restricted to, document verification, source-of-funds scrutiny, or enhanced due diligence. This approach aligns with regulatory expectations while protecting conversion rates and player experience.

Ongoing monitoring vs one-time checks

Modern compliance also treats KYC as a continuous control, not a one-time gate. It is a known fact that fraud evolves over time, based on several factors. As a result, platforms deploy ongoing monitoring to trigger step-up verification, re-screen users, and flag suspicious activity in real-time. This lifecycle-based model is far more effective than one-time checks that are usually executed only at the signup stage.

Reporting, audits, and regulator interactions

Finally, regulatory readiness depends on strong reporting, auditability, and regulator engagement. Compliant-mature operators know how to maintain audit trails, decision logs, and case documentation.

The iGaming KYC workflow

KYC verification in iGaming platforms has a linear process. It begins with the player data capture for verification. The data captured is analyzed for risk signals and continues throughout the gameplay and withdrawal stages. All the transaction logs during these stages are recorded to maintain audit trail and to ensure regulatory compliance.

Player verification: The physical vs digital contrast

Player verification in the real-world casinos is easier since it can be vouched with physical presence and rarely has human oversight. Identity checks are also carried out at entry gates, cash desks, or dedicated VIP counters, as the case may be. Security staff verify government-issued IDs and continue to monitor player behavior and intervene when needed.

Digital casinos operate in a different way. Since digital casinos allow players to join remotely, manual, human-led verification is impractical. There is a need for technical controls that can confirm identity, detect fraud, and prevent multi-accounting. These controls should prevent the player from committing any financial crime and also ensure that money does not leave the platform.

It is here that device intelligence and behavioral signals prove beneficial. Device fingerprinting, IP reputation, geolocation consistency, session behavior, betting velocity, and gameplay anomalies also help in identifying real players from fake profiles and bots.

Related Read: How Device Intelligence Adapts to Global Data Sovereignty

Designing KYC for online casinos without interrupting player experience

Effective KYC in iGaming is about minimizing friction without weakening controls. It may not be possible and practical to verify every single player. However, progressive verification models can be introduced that have light checks and introduce deeper verification only as risk or value increases.

Instead of blocking players with rigid rules, gaming platforms can rely on smart triggers like unusual betting patterns, rapid deposits, bonus exploitation, or location changes. This replaces disruptive “hard stops” with targeted, timely checks.

How to retain high-value players while enforcing strong controls

As mentioned before, a disciplined approach to risk management can help enforce strong controls while retaining players. Leading gaming platforms do this by segmenting players according to risk level, geography, spend, and behavioral patterns. Revenue is also taken into account, but as a secondary signal following these primary signals.

Further, for returning players, trust-based journeys reduce unnecessary friction. Platforms can re-use prior verification data, recognize trusted devices, and apply lighter re-checks unless risk signals change.

Clear, proper communication can also prevent churn and help retain players. Giving context about the checks in place, setting expectations on timelines, and offering real-time status updates helps prevent player frustration and keeps them engaged with the platform.

Related Read: The Next Frontier of Fraud Risk Management: From Reactive Defense to Predictive Trust

Around the world: Regulatory landscape for iGaming KYC

Below is a high-level view of how KYC and AML expectations vary across key iGaming regions and how they impact gaming platforms.

Region | Regulatory maturity | Key KYC / AML requirements | Operational impact on iGaming |

Southeast Asia | Fragmented, evolving | Country-specific licensing (e.g., Philippines PAGCOR), player identity verification, AML screening, payment monitoring | Operators must localize KYC flows by country, manage uneven enforcement, and prepare for future regulatory tightening |

Middle East | Early-stage, restrictive | Strong identity verification, strict payment controls, financial transparency, conservative risk thresholds | Expect slower onboarding, enhanced payment due diligence, and higher compliance friction |

European Union (EU) | Mature, multi-layered | GDPR (data protection), AMLD (AML/CFT), national gaming authority oversight, risk-based KYC, ongoing monitoring | Requires robust data governance, explainable risk decisions, localized regulatory logic, and scalable reporting |

United Kingdom (UK) | Highly mature, strict | UKGC KYC & AML rules, identity verification at onboarding, affordability & financial vulnerability checks, continuous monitoring | Operators must support real-time spend monitoring, affordability triggers, strong audit trails, or risk fines and license action |

Strategic takeaway

Across regions, iGaming is getting regulated in a similar way to how financial services are regulated. The resemblance in operational workflows, volume, variety, and velocity of transactions all contribute to this similar treatment.

Operators that build flexible, region-aware KYC processes and regulator-ready reporting can gain faster market entry, experience fewer disruptions, and enjoy long-term growth.

How to build a future-proof KYC strategy for gaming platforms

Automation, intelligence, and adaptability

Future-ready iGaming operators treat KYC as a strategic capability, not a compliance cost center. The foundation for such a strategic capability is automation, intelligence, and adaptability, as explained below:

Automation helps scale repetitive transactions at higher volumes. It also reduces time required for manual reviews while accelerating player approvals.

Intelligence enabled by artificial intelligence, machine learning, behavioral analytics, and device fingerprinting, helps take faster, more accurate decisions.

Adaptability ensures KYC workflows can evolve quickly as fraud patterns, regulations, and market conditions change.

Partnering vs building internally

There are two ways of enabling a fraud detection and prevention system. Platforms can either choose to partner with an existing system or build one internally.

Building in-house offers control and customization but requires heavy investment in tech stack and its maintenance. Whereas, partnering with a specialized KYC and fraud provider ensures faster deployment, global coverage, and jurisdiction-specific regulatory compliance. Partnering is also known to lower the total cost of ownership, compared to building inhouse.

For most operators, a hybrid model could work best, where the core risk logic stays in-house and is augmented by external intelligence and verification services.

Related Read: From In-House Tools to Unified Fraud Intelligence

Preparing for evolving fraud tactics and regulatory change

Fraudsters use AI and bot-driven attachments to adapt quickly to changing market scenarios and scale up the attacks. Fraud resilience, therefore, depends on preparing for these evolving fraud tactics and regulatory changes.

A future-proof strategy should include rigorous model tuning, regulator-ready audit trails, and cross-functional governance between fraud, compliance, payments, and product teams.

Best practices to stay ahead of compliance and risk management

There is no single checklist that can help any gaming platform stay ahead of compliance and risk management. But, there are certain best practices that can deliver the same result.

To begin with, audit readiness and documentation should be continuous, not reactive.

Gaming platforms must maintain clear KYC decision logs, case histories, source-of-funds records, to smoothen the audit processes, as auditors specifically look for traceability and explainability of risks. Further, they also want to see that the platform follows well-defined retention policies and versioned control frameworks to mitigate such risks.

Internal training and fraud response playbooks are equally critical. Fraud tactics evolve faster than policies. Even with the best tech stack, traditional methods can become obsolete in a matter of weeks. It is, therefore, necessary to constantly update playbooks so they can address common threats such as bonus abuse, account takeovers, money laundering, and fake identity use.

One challenge that most businesses face across all industries is that of siloed tech stacks.

Technology stack alignment across KYC, payments, and fraud can help prevent fraud blind spots. There should be a proper exchange of risk signals between all the relevant systems. Unified data helps reduce false positives, improve decision accuracy, and enables real-time fraud prevention across the player lifecycle.

How Bureau helps reduce iGaming fraud

Bureau adds an external trust layer to the tech stack to strengthen identity verification and fraud prevention. By validating player identity, credit footprint, and historical risk signals, Bureau helps gaming platforms separate real players from fake or high-risk identities.

Bureau’s key benefits include:

Bot detection to block bots, scripts, and AI agents.

An award-winning Device ID to protect users against device abuse.

Proactive gaming KYC that identifies under-age, self-restricted, and blacklisted players.

Play Smart. Verify Faster. Win Player Trust.Bureau’s unified risk decisioning platform helps gaming platforms scale growth while preventing fraud. |

TABLE OF CONTENTS

See More

Recommended Blogs

How Middle East Banks Can Rethink Fraud Prevention

Rapid digital adoption is reshaping banking across the Middle East. Instant onboarding, digital wallets, and super apps are now the norm, expanding the attack surface in the process. To deliver strong protection without adding friction, banks in the region must counter AI-driven fraud with connected intelligence across identity, devices, and behavior.

Building Real-time Defenses in an Always-on Economy

In an always-on, connected economy, risks are created in real-time, rather than at discrete checkpoints. Defense strategies must, accordingly, level up to measure trust throughout the entire user experience, from first interaction to every single transaction. This always-on protection needs connected signals, adaptive decisioning, and protection that can keep pace with evolving digital behaviors and access methods.

How Device Intelligence Adapts to Global Data Sovereignty

Global data sovereignty laws are forcing financial institutions to rethink device intelligence, redesign fraud architecture, and operate compliant, real-time risk systems across increasingly fragmented regulatory environments. What this means in practice is a fundamental shift in how businesses design, deploy, and govern fraud systems across regions.

TABLE OF CONTENTS

See Less

Solutions

Resources

© 2026 Bureau . All rights reserved.

Solutions

Industries

Resources

Company

Solutions

Industries

Resources

Company

© 2026 Bureau . All rights reserved.

Follow Us

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence

© 2026 Bureau . All rights reserved.