Feb 18, 2026

Building Real-time Defenses in an Always-on Economy

Building Real-time Defenses in an Always-on Economy

Building Real-time Defenses in an Always-on Economy

In an always-on, connected economy, risks are created in real-time, rather than at discrete checkpoints. Defense strategies must, accordingly, level up to measure trust throughout the entire user experience, from first interaction to every single transaction. This always-on protection needs connected signals, adaptive decisioning, and protection that can keep pace with evolving digital behaviors and access methods.

Author

Nikhil Jois

TABLE OF CONTENTS

See Less

It’s now possible to plan vacations using a smartphone, without ever leaving the bed.

One can pay for meals with just a tap on the watch. Frictionless. No need for a wallet. No need for a card.

Sitting in Mumbai, or for that matter in Udaipur, Guntur, or Jamtara, one can now invest in equities in the United States, while tracking the opening bell of the NYSE as Indian markets close. Or, trade crypto in the time it takes to order a coffee!

Such seamless real-time access is now normal.

And when reviewed in context, it is remarkable.

Welcome to the always-on economy!

Always-on access is now the norm

A decade ago, making an online payment would mean needing access to a desktop computer often during the regular business hours. Big purchases meant big friction, intentionally. Digital spending was less mobile, less instantaneous, and far less embedded in everyday life than it is today.

Now the economy runs 24x7x365. Transactions are increasingly device-agnostic, across borders, and with near zero friction. The time between "I want this" and "I bought this” is shrinking to seconds!

The shift becomes clear when viewed through the scale of digital behavior. What once required effort and intent now happens instantly and continuously. Here’s the always-on economy in terms of numbers:

7.3 billion active smartphone subscriptions globally in 2025.

40 apps on average are installed on a smartphone, with 11+ apps used every single day.

3.5 hours are spent daily on mobile apps.

300 billion app downloads worldwide were recorded in 2025 alone.

186 is the number of times an average American checks the phone.

And it's not just the consumers; investors, too, have gone borderless.

According to the RBI data, Indian overseas investments have jumped 54.5% since January 2025. India now has 200+ million demat accounts, with 23.5 million new additions in FY26 alone. That's 120 million unique retail investors, many of them trading global equities from their phones while commuting to work.

Related Read: Driving Financial Inclusion and Accessibility with Secure Digital Payments

Access has scaled faster than controls

The AI era has accelerated the pace of action, and how? One might go so far as to argue that this is a more profound change than the advent of the internet itself. But here's what is most commonly missed out:

Fraudsters have evolved too; and they have evolved faster than the risk and compliance frameworks can adapt.

Just about a decade ago, fraud was an individual-driven game. Hackers would target loopholes in business networks, mostly for bragging rights. The money was almost a bonus.

Five years later, lone-wolf attacks evolved into a cottage industry, with small groups of fraudsters sharing playbooks and coordinating attacks.

Cut to today; fraud is an industry in itself. At $10.5 trillion in 2025, cybercrime is now the third largest economy, after the US and China. Cyber slavery rings, fraud hubs across continents, and organized crime at scale, make fraud operations look more like corporations than criminals.

Point-in-time defenses are no match to continuous fraud

Just like the always-on economy, fraud now operates as a continuous, borderless business. However, most defenses remain point-in-time, activating at moments rather than across journeys.

Most systems still work like this:

Identity is checked at onboarding, post which visibility across the user lifecycle becomes limited.

Transactions are monitored using static rules, which means responses are based on patterns fraudsters have already moved past.

Authentication and fraud detection are treated as separate problems, resulting in missed connections between identity, behavior, and device risk signals.

This approach worked well when transactions happened during banking hours on a desktop in one country. It doesn't work now, when users are buying stocks at 2 a.m. from a wearable device in a different time zone.

Related Read: A Food Delivery Company Eliminates a 2,700+ User Fraud Ring

What actually works in an always-on economy

An always-on economy demands an always-on protection that can span the entire user journey. Protection that does not stop at login or activates only at checkout. It operates continuously, wherever risk can emerge. Achieving this continuous protection requires signals that persist across sessions, devices, and accounts.

The following capabilities can provide the desired visibility and control.

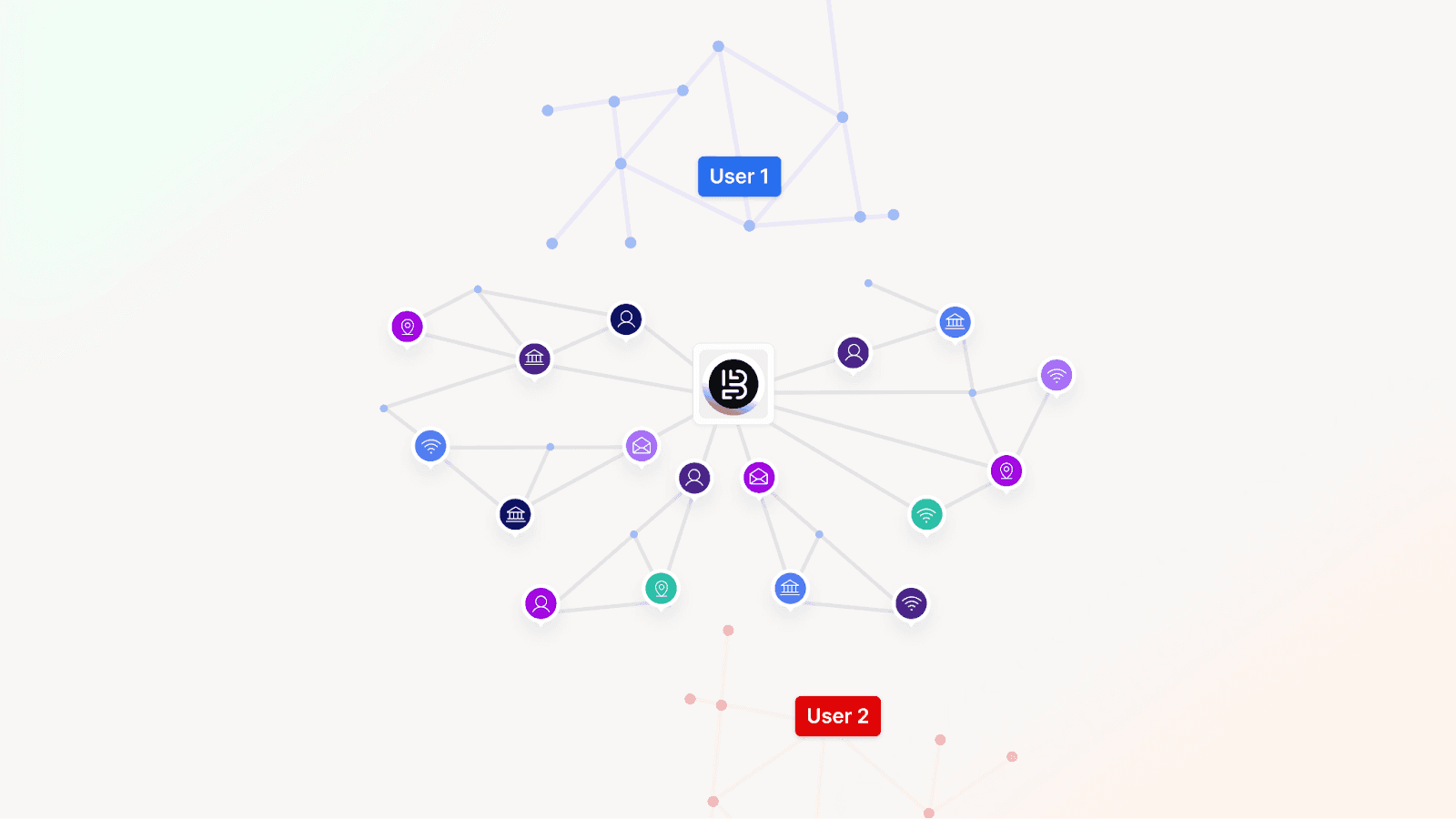

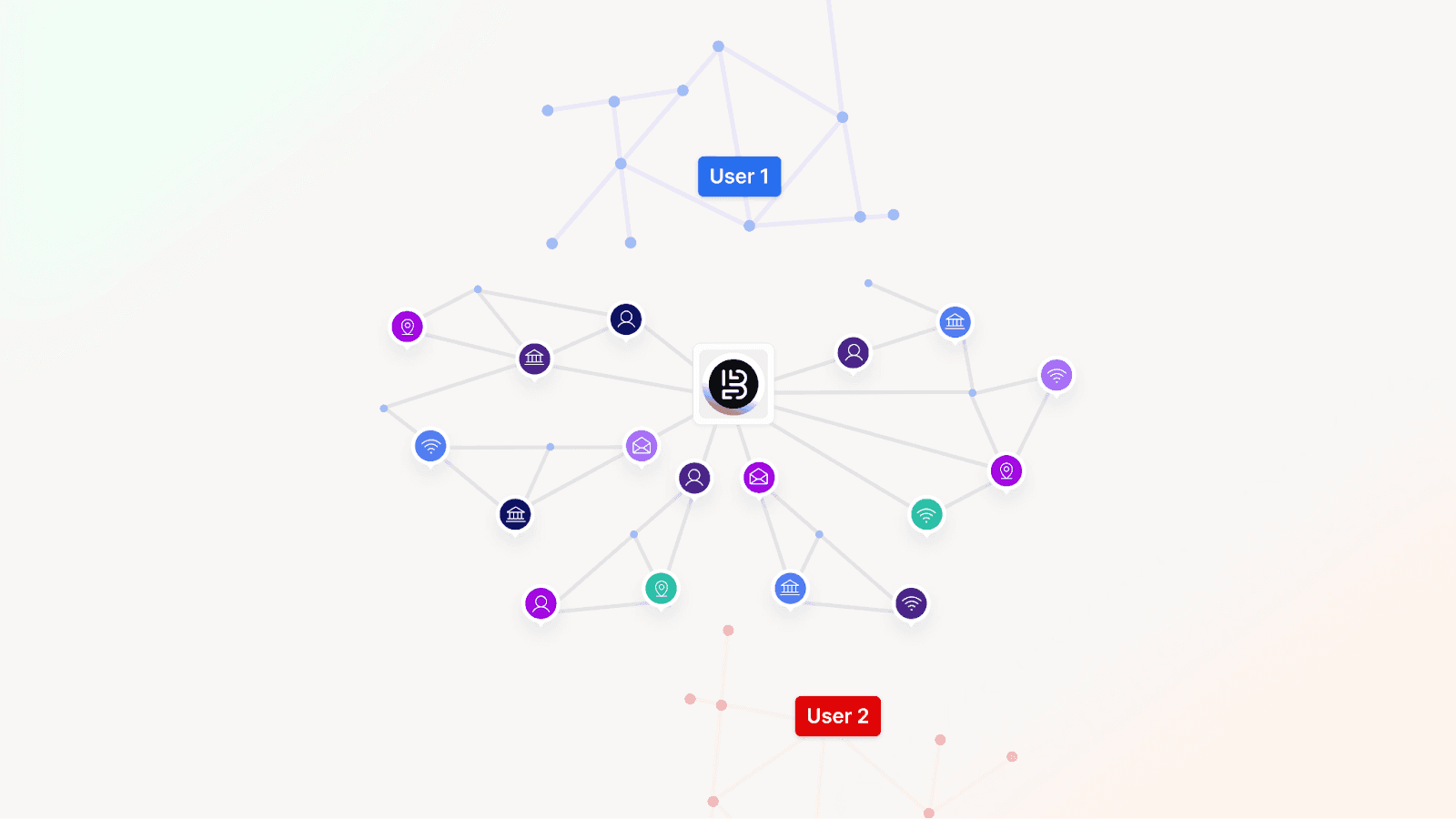

Device intelligence: Enables platforms to assess trust at the very first interaction by evaluating the device even before the user is fully known, helping surface high-risk signals early.

Behavioral biometrics: Strengthens verification by analyzing how a person types, swipes, and holds a device, patterns that cannot be replicated even when credentials are compromised.

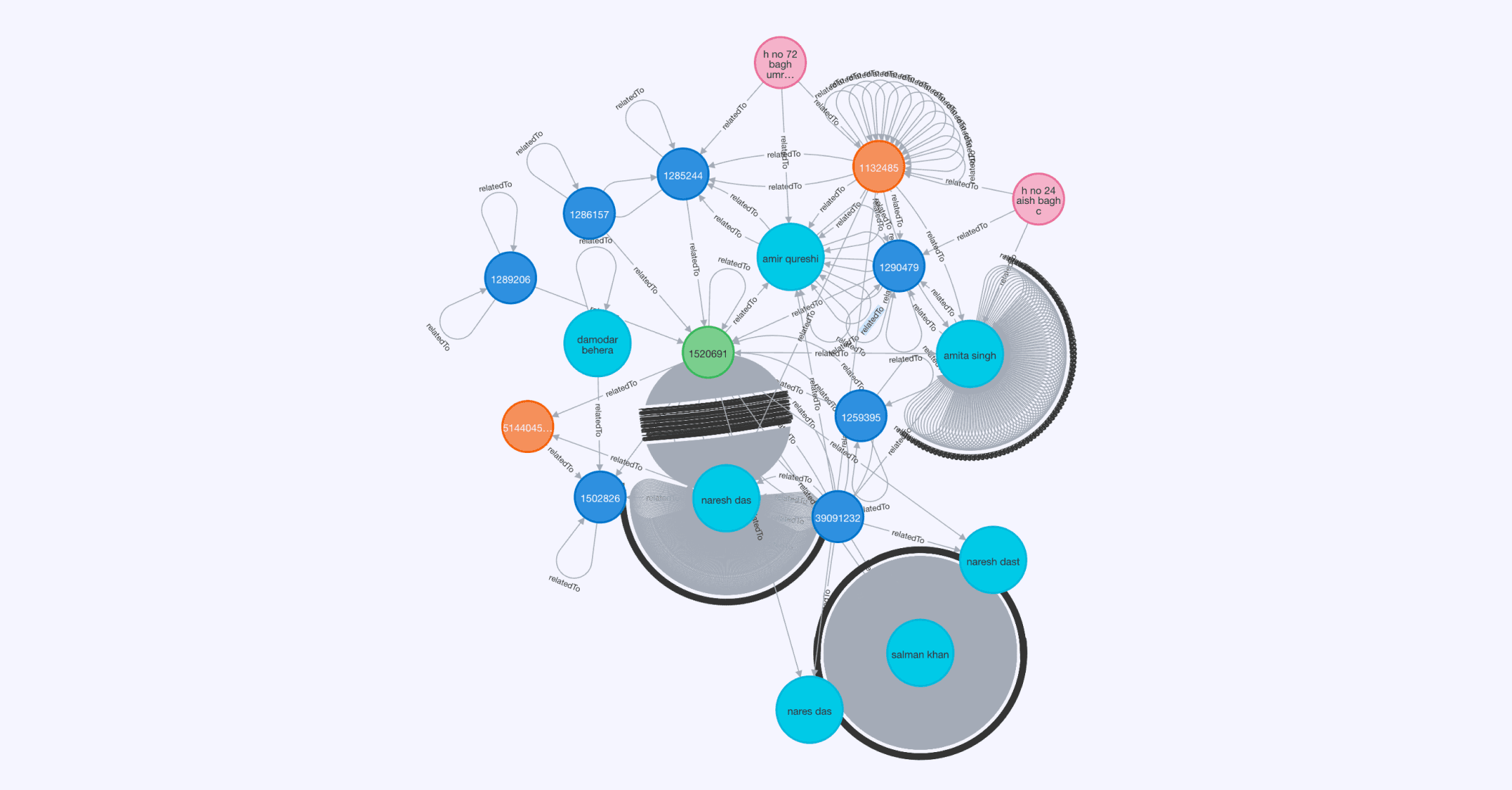

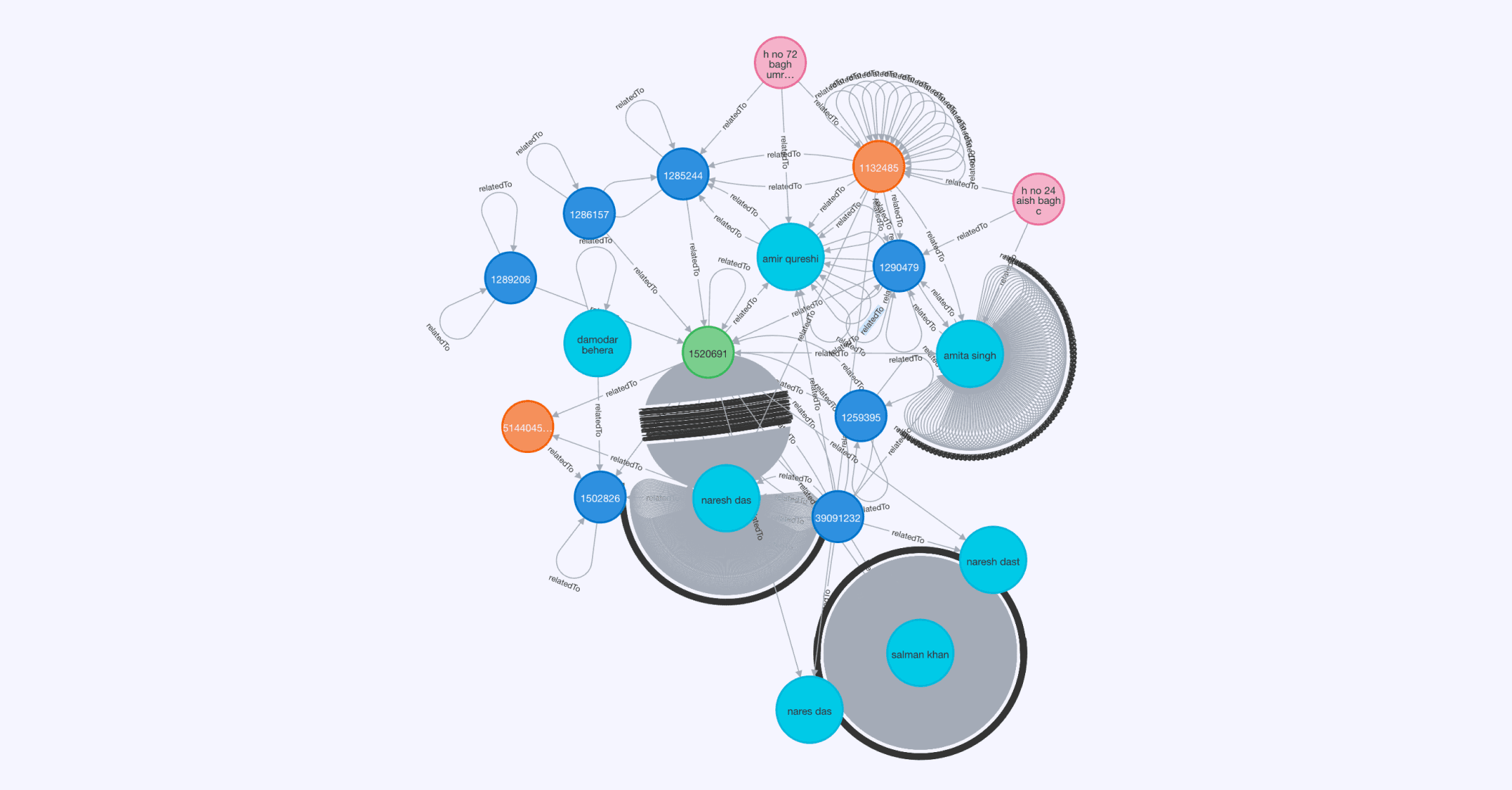

Graph networks: Uncover hidden relationships across accounts, devices, and transactions, allowing platforms to detect collusion and disrupt fraud rings before they scale.

Real-time decisioning: Ensures risk is continuously evaluated throughout the session, allowing responses to adapt instantly as user behavior or context changes.

Because the always-on economy is now the baseline, fraud defenses must operate with the same continuity, intelligence, and speed.

Bureau enables global brands to build continuous and always-on protection that is designed for real-world digital behavior. Businesses focused on strengthening consumer trust across fintech, payments, and platform ecosystems can explore what this looks like in practice by scheduling a demo here.

It’s now possible to plan vacations using a smartphone, without ever leaving the bed.

One can pay for meals with just a tap on the watch. Frictionless. No need for a wallet. No need for a card.

Sitting in Mumbai, or for that matter in Udaipur, Guntur, or Jamtara, one can now invest in equities in the United States, while tracking the opening bell of the NYSE as Indian markets close. Or, trade crypto in the time it takes to order a coffee!

Such seamless real-time access is now normal.

And when reviewed in context, it is remarkable.

Welcome to the always-on economy!

Always-on access is now the norm

A decade ago, making an online payment would mean needing access to a desktop computer often during the regular business hours. Big purchases meant big friction, intentionally. Digital spending was less mobile, less instantaneous, and far less embedded in everyday life than it is today.

Now the economy runs 24x7x365. Transactions are increasingly device-agnostic, across borders, and with near zero friction. The time between "I want this" and "I bought this” is shrinking to seconds!

The shift becomes clear when viewed through the scale of digital behavior. What once required effort and intent now happens instantly and continuously. Here’s the always-on economy in terms of numbers:

7.3 billion active smartphone subscriptions globally in 2025.

40 apps on average are installed on a smartphone, with 11+ apps used every single day.

3.5 hours are spent daily on mobile apps.

300 billion app downloads worldwide were recorded in 2025 alone.

186 is the number of times an average American checks the phone.

And it's not just the consumers; investors, too, have gone borderless.

According to the RBI data, Indian overseas investments have jumped 54.5% since January 2025. India now has 200+ million demat accounts, with 23.5 million new additions in FY26 alone. That's 120 million unique retail investors, many of them trading global equities from their phones while commuting to work.

Related Read: Driving Financial Inclusion and Accessibility with Secure Digital Payments

Access has scaled faster than controls

The AI era has accelerated the pace of action, and how? One might go so far as to argue that this is a more profound change than the advent of the internet itself. But here's what is most commonly missed out:

Fraudsters have evolved too; and they have evolved faster than the risk and compliance frameworks can adapt.

Just about a decade ago, fraud was an individual-driven game. Hackers would target loopholes in business networks, mostly for bragging rights. The money was almost a bonus.

Five years later, lone-wolf attacks evolved into a cottage industry, with small groups of fraudsters sharing playbooks and coordinating attacks.

Cut to today; fraud is an industry in itself. At $10.5 trillion in 2025, cybercrime is now the third largest economy, after the US and China. Cyber slavery rings, fraud hubs across continents, and organized crime at scale, make fraud operations look more like corporations than criminals.

Point-in-time defenses are no match to continuous fraud

Just like the always-on economy, fraud now operates as a continuous, borderless business. However, most defenses remain point-in-time, activating at moments rather than across journeys.

Most systems still work like this:

Identity is checked at onboarding, post which visibility across the user lifecycle becomes limited.

Transactions are monitored using static rules, which means responses are based on patterns fraudsters have already moved past.

Authentication and fraud detection are treated as separate problems, resulting in missed connections between identity, behavior, and device risk signals.

This approach worked well when transactions happened during banking hours on a desktop in one country. It doesn't work now, when users are buying stocks at 2 a.m. from a wearable device in a different time zone.

Related Read: A Food Delivery Company Eliminates a 2,700+ User Fraud Ring

What actually works in an always-on economy

An always-on economy demands an always-on protection that can span the entire user journey. Protection that does not stop at login or activates only at checkout. It operates continuously, wherever risk can emerge. Achieving this continuous protection requires signals that persist across sessions, devices, and accounts.

The following capabilities can provide the desired visibility and control.

Device intelligence: Enables platforms to assess trust at the very first interaction by evaluating the device even before the user is fully known, helping surface high-risk signals early.

Behavioral biometrics: Strengthens verification by analyzing how a person types, swipes, and holds a device, patterns that cannot be replicated even when credentials are compromised.

Graph networks: Uncover hidden relationships across accounts, devices, and transactions, allowing platforms to detect collusion and disrupt fraud rings before they scale.

Real-time decisioning: Ensures risk is continuously evaluated throughout the session, allowing responses to adapt instantly as user behavior or context changes.

Because the always-on economy is now the baseline, fraud defenses must operate with the same continuity, intelligence, and speed.

Bureau enables global brands to build continuous and always-on protection that is designed for real-world digital behavior. Businesses focused on strengthening consumer trust across fintech, payments, and platform ecosystems can explore what this looks like in practice by scheduling a demo here.

TABLE OF CONTENTS

See More

TABLE OF CONTENTS

See More

Recommended Blogs

iGaming KYC: Balancing Risk, Compliance, and Player Experience

KYC-driven identity verification is a core element for fraud prevention in iGaming. It helps these platforms establish trust at onboarding by creating a secure, fair, and sustainable ecosystem, preventing abuse, preserving integrity of the platform, and ensuring regulatory compliance.

How Device Intelligence Adapts to Global Data Sovereignty

Global data sovereignty laws are forcing financial institutions to rethink device intelligence, redesign fraud architecture, and operate compliant, real-time risk systems across increasingly fragmented regulatory environments. What this means in practice is a fundamental shift in how businesses design, deploy, and govern fraud systems across regions.

When Fraud Outgrows SQL: Rethinking Risk Monitoring Systems

Today’s fraud is real-time, networked, and AI-assisted. It moves across accounts, devices, and platforms faster than SQL queries can keep up. That’s why rule-based monitoring fails quietly and risk is detected only after the damage is done.

TABLE OF CONTENTS

See Less

TABLE OF CONTENTS

See Less

Solutions

Resources

© 2026 Bureau . All rights reserved.

Solutions

Solutions

Industries

Industries

Resources

Resources

Company

Company

Solutions

Solutions

Industries

Industries

Resources

Resources

Company

Company

© 2025 Bureau . All rights reserved. Privacy Policy. Terms of Service.

© 2025 Bureau . All rights reserved.

Privacy Policy. Terms of Service.

Follow Us

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence