Dec 15, 2025

Address Verification: The Foundation of Trust in Digital Transactions

Address Verification: The Foundation of Trust in Digital Transactions

Address Verification: The Foundation of Trust in Digital Transactions

Address verification forms the foundation of trust in digital transactions. Businesses can level up their fraud prevention efforts, compliance, and operational efficiency with Bureau’s intelligent, integrated, and real-time address verification that combines AI, geolocation, and alternative data

TABLE OF CONTENTS

See Less

Trust is the bedrock of every transaction in the digital-first economy. Whether it is opening a bank account, online shopping, or app-based ride hailing, businesses must not only confirm who the user is, but also where they are located. This is where address verification assumes critical importance.

Address verification is a foundational step that can help businesses bridge customer convenience, operational accuracy, and fraud prevention. Although address verification may seem like a background process, it’s one of the strongest pillars of digital trust. It protects businesses from fraud, strengthens compliance, and powers confident user interactions.

As global identity systems evolve, static address checks are giving way to intelligent, contextual verification powered by AI and alternative data. To stay ahead of fraud, businesses must move from basic verification to intelligent decisioning, using user addresses as identity anchors.

Address verification explained

With an increase in the volumes of digital identities, the risks of impersonation and fraud also multiply. Address verification can serve as a critical checkpoint in confirming that a user attempting a transaction is real and legitimate.

Address verification is the process of confirming that an address provided by a user actually exists and is genuinely linked to the user. It ensures that customers, merchants, or service partners are real, traceable, and reachable; and not anonymous digital entities hiding behind fake credentials.

While it may sound straightforward, address verification can be complex. Having evolved beyond postal code checks, it now enables businesses to confidently assess whether an individual or entity is authentic or likely to engage in fraudulent behavior. This supports navigating risk in an increasingly borderless world, while also ensuring compliance with evolving fraud prevention regulations.

Typically address verification involves matching an address against:

Postal databases or geolocation data

Credit bureaus and government registries

Utility, telecom, or alternative data sources

User-submitted documents or proofs of residence

Why address verification matters

Address verification acts like a safeguard against potential fraud and operational failure. By investing in modern address verification mechanisms, businesses can protect their bottom line as well as strengthen customer relation through:

Fraud prevention: Address mismatch can be an early warning sign of false or stolen address information, identity theft, card-not-present (CNP) fraud, or synthetic identity creation. By validating addresses and misaligned device signals, businesses can prevent fake account creation and payment fraud.

Compliance and risk management: In sectors such as banking, fintech, and insurance, verifying customer addresses is a regulatory necessity. Address verification forms part of a broader due diligence process, KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements that protect businesses from penalties and misuse.

Operational efficiency: Inaccurate or incomplete addresses result in failed deliveries, chargebacks, and customer dissatisfaction, impacting revenue and user experience for logistics, eCommerce, and gig platforms. Verified addresses support smooth operations, from dispatch to doorstep.

Customer trust: Seamless verification builds user confidence. With frictionless onboarding, businesses can improve customer loyalty and retention.

Common steps in address verification

Address verification is central to modern digital ecosystems. Integrating AI, geolocation, and device intelligence, modern verification platforms not only enhance accuracy but can also detect subtle inconsistencies, such as an address that exists, but doesn’t correlate with a user’s device behavior or IP region.

While the manner in which various industries approach address verification may differ, the core process usually involves the following stages:

Data capture: User provides address during sign-up or checkout. Real-time input validation prevents errors like typos or missing postal codes.

Normalization: The address is standardized according to postal or geographic conventions.

Database matching: The address is checked against authoritative databases, such as postal services, credit bureaus, or alternative datasets.

Association check: Systems verify whether the provided address is linked to the individual claiming it.

Decisioning: Based on match confidence and other signals, the system approves, flags, or requests further verification.

Address verification across industries

Address verification touches nearly every digital industry. Depending on the unique challenge they face, businesses use it for fraud prevention, compliance, and operational accuracy.

Financial Services: To detect synthetic identities, and make trust decisions during onboarding, card issuance, and lending.

eCommerce and Retail: To validate billing and shipping addresses, prevent chargeback fraud, and ensure successful deliveries.

Gig, Mobility, and Delivery Platforms: To verify both customers and service providers, ensure location authenticity and safety, improve dispatch efficiency, and optimize routes.

Government and Public Services: To disburse benefits, prevent duplicate registrations, and manage regional eligibility for public schemes.

Challenges in address verification

Despite its importance, address verification isn’t as straightforward as it may sound. Globalization, mobility, and data fragmentation make it challenging to confirm who lives where. In addition, there are several challenges that can make address verification complex. These include:

Diverse formats across regions: Need for verification logic according to regional nuances as addresses do not follow a universal standard. For instance, the U.S. uses the ZIP-based system, whereas the PIN system is prevalent in India and block-based address system in Japan.

Limited or outdated data: Postal databases that are either incomplete or outdated can make address verification difficult.

Dynamic residences: The rising trends of urban migration, short-term rentals, and co-living, result in users changing addresses frequently and static records failing to keep up.

Privacy and compliance: Data protection laws like GDPR and regional equivalents restrict how address data can be stored or shared.

Techniques powering modern address verification systems

As fraud grows more adaptive, address verification is evolving into a multi-layered intelligence system. From a one-time check and focus on existence (does this address exist?), address verification has now moved on to continuous updates and association (does this address belong to this person?).

Most modern address verification systems use a combination of latest digital technologies such as described below:

AI and Machine Learning: To help detect subtle anomalies that human sight can miss. These may include spelling errors, inconsistent formatting, or improbable combinations of address elements. AI-powered systems learn from legitimate user behavior over time, improving future accuracy.

Geolocation and Device Intelligence: To detect potential fraud by flagging inconsistencies in device location or network signals with a user’s claimed address.

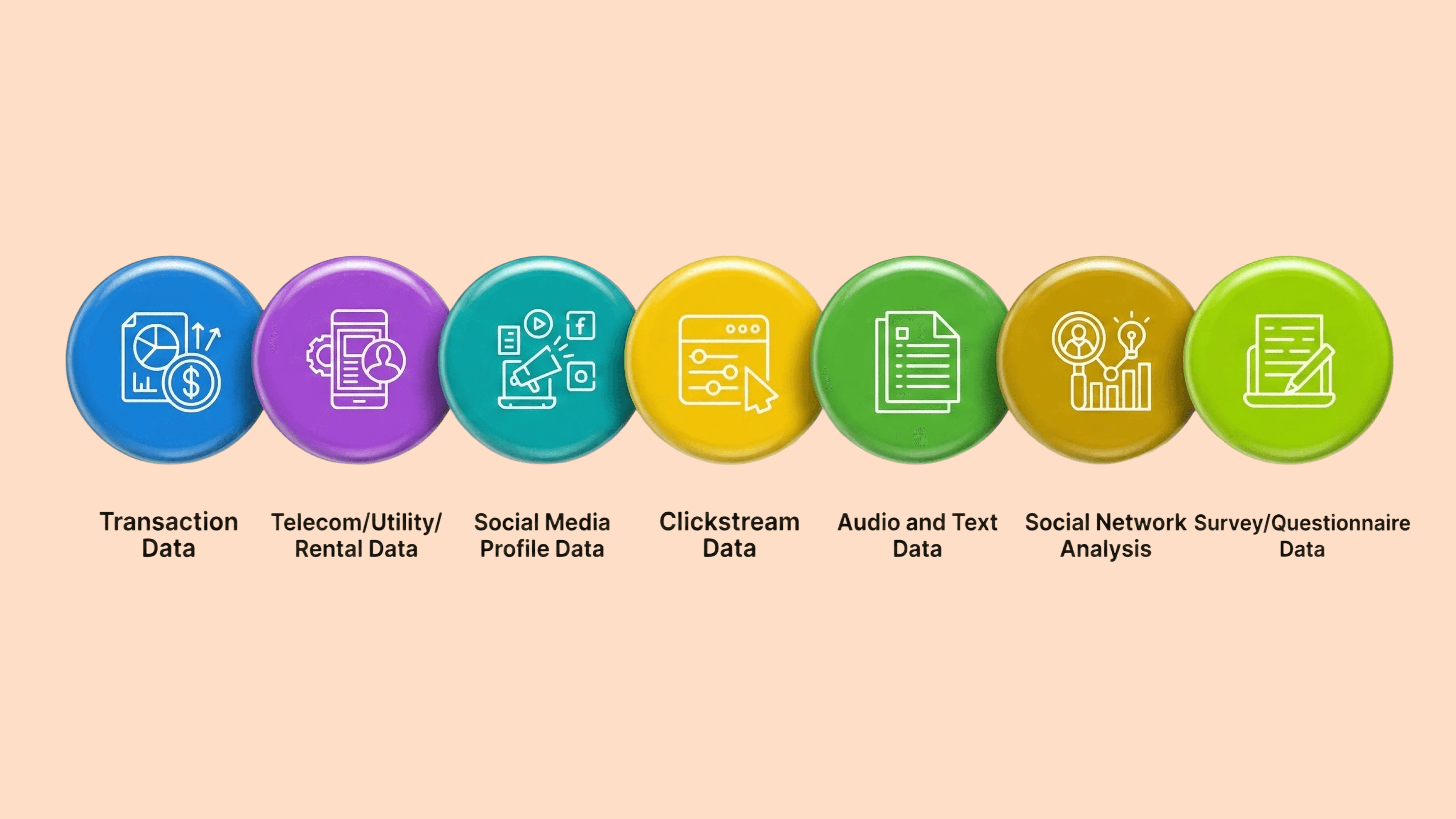

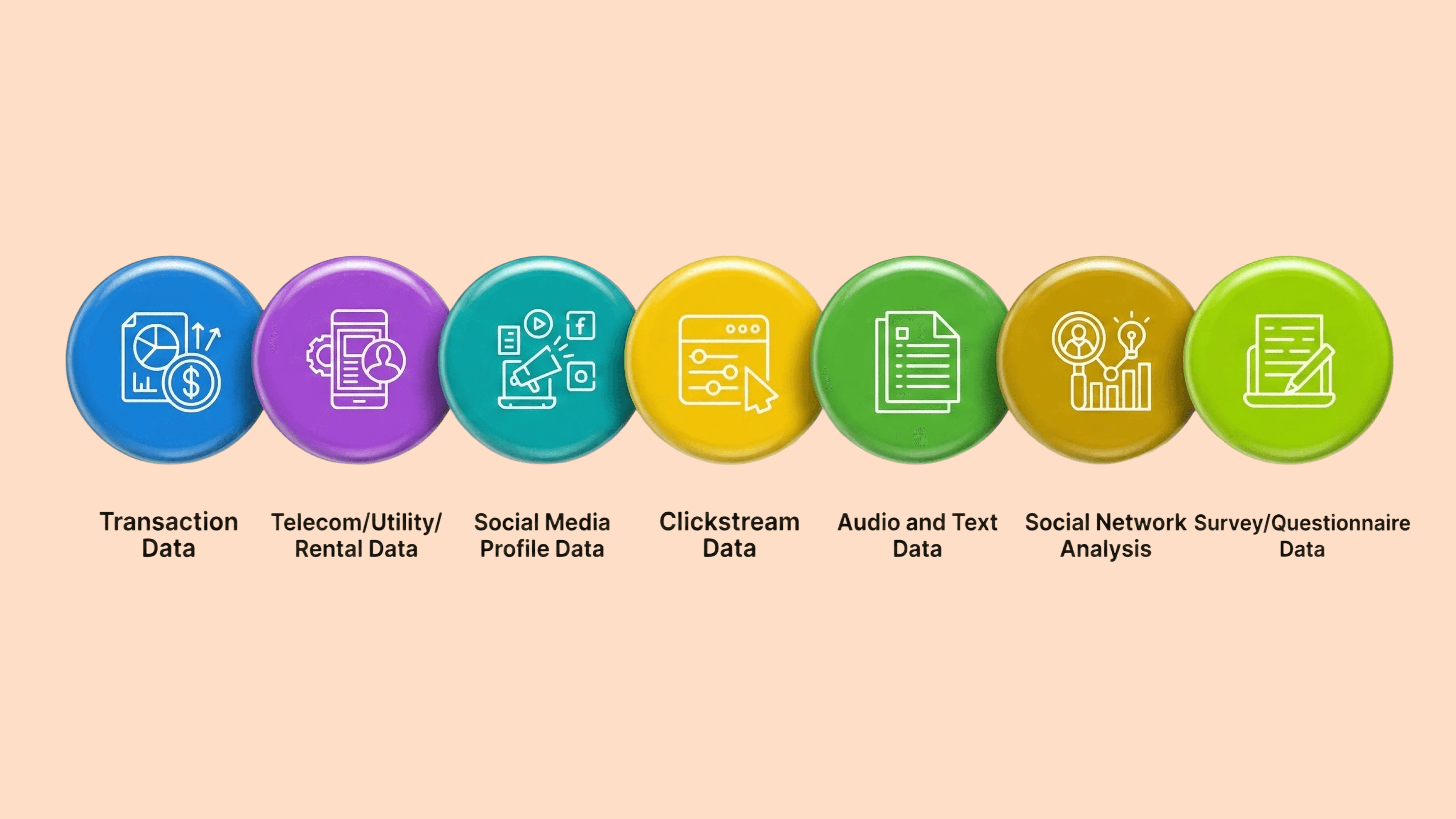

Alternate Data Sources: To fill in verification gaps, with reliable, new age data sets, such as utility registrations, telco data, or app-based digital footprints.

API-driven Real-time Checks: To improve user experience while reducing operational cost.

Enhance address verification with Bureau

Dynamic address verification requires analyzing multiple signals simultaneously. Bureau’s unified risk decisioning platform helps businesses move beyond database lookups toward intelligent, real-time identity decisioning.

Bureau’s platform combines address, device, behavioral, and alternate data to deliver a 360° view of identity, ensuring that an address not only exists but genuinely belongs to the person claiming it. With Bureau, businesses experience fewer false positives, faster onboarding, and stronger fraud prevention, without compromising compliance or user experience.

Key differentiators that set Bureau apart from the others on the market include:

Multi-source validation: | A combination of postal, utility, telco, and government data for comprehensive coverage. |

AI-driven normalization: | Automatically corrects errors and standardizes addresses for global consistency. |

Geolocation correlation: | Matches physical addresses with device and IP data to detect anomalies. |

Integrated decisioning: | Embeds address verification within the platform, linking multiple fraud and identity signals in real time. |

Ongoing monitoring: | Keeps customer records current as users relocate or update information. |

Learn how Bureau turns every address into a trust signal, enabling businesses to improve fraud detection accuracy and power global expansion; book a no-obligation demo now.

Trust is the bedrock of every transaction in the digital-first economy. Whether it is opening a bank account, online shopping, or app-based ride hailing, businesses must not only confirm who the user is, but also where they are located. This is where address verification assumes critical importance.

Address verification is a foundational step that can help businesses bridge customer convenience, operational accuracy, and fraud prevention. Although address verification may seem like a background process, it’s one of the strongest pillars of digital trust. It protects businesses from fraud, strengthens compliance, and powers confident user interactions.

As global identity systems evolve, static address checks are giving way to intelligent, contextual verification powered by AI and alternative data. To stay ahead of fraud, businesses must move from basic verification to intelligent decisioning, using user addresses as identity anchors.

Address verification explained

With an increase in the volumes of digital identities, the risks of impersonation and fraud also multiply. Address verification can serve as a critical checkpoint in confirming that a user attempting a transaction is real and legitimate.

Address verification is the process of confirming that an address provided by a user actually exists and is genuinely linked to the user. It ensures that customers, merchants, or service partners are real, traceable, and reachable; and not anonymous digital entities hiding behind fake credentials.

While it may sound straightforward, address verification can be complex. Having evolved beyond postal code checks, it now enables businesses to confidently assess whether an individual or entity is authentic or likely to engage in fraudulent behavior. This supports navigating risk in an increasingly borderless world, while also ensuring compliance with evolving fraud prevention regulations.

Typically address verification involves matching an address against:

Postal databases or geolocation data

Credit bureaus and government registries

Utility, telecom, or alternative data sources

User-submitted documents or proofs of residence

Why address verification matters

Address verification acts like a safeguard against potential fraud and operational failure. By investing in modern address verification mechanisms, businesses can protect their bottom line as well as strengthen customer relation through:

Fraud prevention: Address mismatch can be an early warning sign of false or stolen address information, identity theft, card-not-present (CNP) fraud, or synthetic identity creation. By validating addresses and misaligned device signals, businesses can prevent fake account creation and payment fraud.

Compliance and risk management: In sectors such as banking, fintech, and insurance, verifying customer addresses is a regulatory necessity. Address verification forms part of a broader due diligence process, KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements that protect businesses from penalties and misuse.

Operational efficiency: Inaccurate or incomplete addresses result in failed deliveries, chargebacks, and customer dissatisfaction, impacting revenue and user experience for logistics, eCommerce, and gig platforms. Verified addresses support smooth operations, from dispatch to doorstep.

Customer trust: Seamless verification builds user confidence. With frictionless onboarding, businesses can improve customer loyalty and retention.

Common steps in address verification

Address verification is central to modern digital ecosystems. Integrating AI, geolocation, and device intelligence, modern verification platforms not only enhance accuracy but can also detect subtle inconsistencies, such as an address that exists, but doesn’t correlate with a user’s device behavior or IP region.

While the manner in which various industries approach address verification may differ, the core process usually involves the following stages:

Data capture: User provides address during sign-up or checkout. Real-time input validation prevents errors like typos or missing postal codes.

Normalization: The address is standardized according to postal or geographic conventions.

Database matching: The address is checked against authoritative databases, such as postal services, credit bureaus, or alternative datasets.

Association check: Systems verify whether the provided address is linked to the individual claiming it.

Decisioning: Based on match confidence and other signals, the system approves, flags, or requests further verification.

Address verification across industries

Address verification touches nearly every digital industry. Depending on the unique challenge they face, businesses use it for fraud prevention, compliance, and operational accuracy.

Financial Services: To detect synthetic identities, and make trust decisions during onboarding, card issuance, and lending.

eCommerce and Retail: To validate billing and shipping addresses, prevent chargeback fraud, and ensure successful deliveries.

Gig, Mobility, and Delivery Platforms: To verify both customers and service providers, ensure location authenticity and safety, improve dispatch efficiency, and optimize routes.

Government and Public Services: To disburse benefits, prevent duplicate registrations, and manage regional eligibility for public schemes.

Challenges in address verification

Despite its importance, address verification isn’t as straightforward as it may sound. Globalization, mobility, and data fragmentation make it challenging to confirm who lives where. In addition, there are several challenges that can make address verification complex. These include:

Diverse formats across regions: Need for verification logic according to regional nuances as addresses do not follow a universal standard. For instance, the U.S. uses the ZIP-based system, whereas the PIN system is prevalent in India and block-based address system in Japan.

Limited or outdated data: Postal databases that are either incomplete or outdated can make address verification difficult.

Dynamic residences: The rising trends of urban migration, short-term rentals, and co-living, result in users changing addresses frequently and static records failing to keep up.

Privacy and compliance: Data protection laws like GDPR and regional equivalents restrict how address data can be stored or shared.

Techniques powering modern address verification systems

As fraud grows more adaptive, address verification is evolving into a multi-layered intelligence system. From a one-time check and focus on existence (does this address exist?), address verification has now moved on to continuous updates and association (does this address belong to this person?).

Most modern address verification systems use a combination of latest digital technologies such as described below:

AI and Machine Learning: To help detect subtle anomalies that human sight can miss. These may include spelling errors, inconsistent formatting, or improbable combinations of address elements. AI-powered systems learn from legitimate user behavior over time, improving future accuracy.

Geolocation and Device Intelligence: To detect potential fraud by flagging inconsistencies in device location or network signals with a user’s claimed address.

Alternate Data Sources: To fill in verification gaps, with reliable, new age data sets, such as utility registrations, telco data, or app-based digital footprints.

API-driven Real-time Checks: To improve user experience while reducing operational cost.

Enhance address verification with Bureau

Dynamic address verification requires analyzing multiple signals simultaneously. Bureau’s unified risk decisioning platform helps businesses move beyond database lookups toward intelligent, real-time identity decisioning.

Bureau’s platform combines address, device, behavioral, and alternate data to deliver a 360° view of identity, ensuring that an address not only exists but genuinely belongs to the person claiming it. With Bureau, businesses experience fewer false positives, faster onboarding, and stronger fraud prevention, without compromising compliance or user experience.

Key differentiators that set Bureau apart from the others on the market include:

Multi-source validation: | A combination of postal, utility, telco, and government data for comprehensive coverage. |

AI-driven normalization: | Automatically corrects errors and standardizes addresses for global consistency. |

Geolocation correlation: | Matches physical addresses with device and IP data to detect anomalies. |

Integrated decisioning: | Embeds address verification within the platform, linking multiple fraud and identity signals in real time. |

Ongoing monitoring: | Keeps customer records current as users relocate or update information. |

Learn how Bureau turns every address into a trust signal, enabling businesses to improve fraud detection accuracy and power global expansion; book a no-obligation demo now.

TABLE OF CONTENTS

See More

TABLE OF CONTENTS

See More

Recommended Blogs

Building Real-time Defenses in an Always-on Economy

In an always-on, connected economy, risks are created in real-time, rather than at discrete checkpoints. Defense strategies must, accordingly, level up to measure trust throughout the entire user experience, from first interaction to every single transaction. This always-on protection needs connected signals, adaptive decisioning, and protection that can keep pace with evolving digital behaviors and access methods.

iGaming KYC: Balancing Risk, Compliance, and Player Experience

KYC-driven identity verification is a core element for fraud prevention in iGaming. It helps these platforms establish trust at onboarding by creating a secure, fair, and sustainable ecosystem, preventing abuse, preserving integrity of the platform, and ensuring regulatory compliance.

How Device Intelligence Adapts to Global Data Sovereignty

Global data sovereignty laws are forcing financial institutions to rethink device intelligence, redesign fraud architecture, and operate compliant, real-time risk systems across increasingly fragmented regulatory environments. What this means in practice is a fundamental shift in how businesses design, deploy, and govern fraud systems across regions.

TABLE OF CONTENTS

See Less

TABLE OF CONTENTS

See Less

Solutions

Resources

© 2026 Bureau . All rights reserved.

Solutions

Solutions

Industries

Industries

Resources

Resources

Company

Company

Solutions

Solutions

Industries

Industries

Resources

Resources

Company

Company

© 2025 Bureau . All rights reserved. Privacy Policy. Terms of Service.

© 2025 Bureau . All rights reserved.

Privacy Policy. Terms of Service.

Follow Us

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence