From In-House Tools to Unified Fraud Intelligence

From In-House Tools to Unified Fraud Intelligence

From In-House Tools to Unified Fraud Intelligence

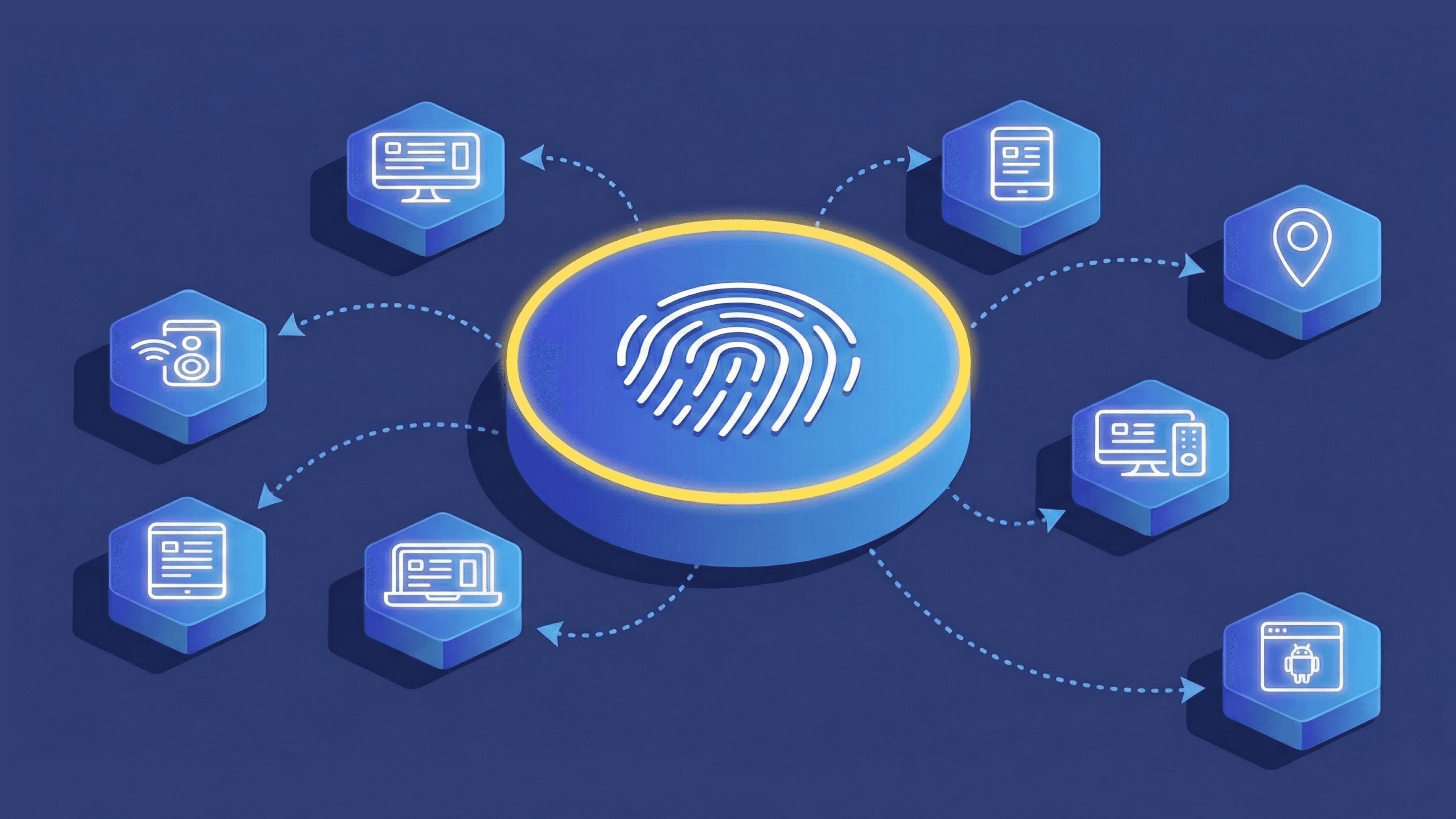

Device fingerprinting helps identify spoofing, bots, and repeat abuse by recognizing unique device attributes, even when fraudsters spoof emails or IPs. For businesses, the decision, whether to build this capability in-house or rely on a specialized partner, can directly shape how quickly teams can adapt to evolving threats.

Device fingerprinting helps identify spoofing, bots, and repeat abuse by recognizing unique device attributes, even when fraudsters spoof emails or IPs. For businesses, the decision, whether to build this capability in-house or rely on a specialized partner, can directly shape how quickly teams can adapt to evolving threats.

Device fingerprinting helps identify spoofing, bots, and repeat abuse by recognizing unique device attributes, even when fraudsters spoof emails or IPs. For businesses, the decision, whether to build this capability in-house or rely on a specialized partner, can directly shape how quickly teams can adapt to evolving threats.

TABLE OF CONTENTS

See More

TABLE OF CONTENTS

See More

Sophisticated fraud schemes powered by artificial intelligence and automation continue to surge and help fraudsters target gaps in traditional controls. It is estimated that generative AI may power losses worth $40 billion by 2027.

At the same time, businesses are under pressure to streamline their onboarding and transaction flows to deliver frictionless user experiences. This rush creates blind spots and vulnerabilities that can be easily exploited by automated systems.

Solutions like device fingerprinting offer a reliable method of identifying the unique attributes of a device to detect spoofing, bots, and repeated abuse. When done well, device fingerprinting can act as a strong shield against fraud even when user identifiers like email or IP addresses are changed.

However, this creates a dilemma for leaders: should they build device fingerprinting capabilities internally, or buy them from a specialized partner?

This decision has a long-term effect as it would decide how quickly IT teams can respond to evolving threats.

Device Fingerprinting: Decoding A Core Fraud Signal

Think of a device fingerprint as a digital DNA that links machines and sessions across time and context. This link helps fraud teams diagnose patterns in user behavior that can lead to fraud discovery.

Is Your In-House Fraud Stack Scaling?

Is Your In-House Fraud Stack Scaling?

Talk to a fraud specialist about scaling challenges.

Talk to Our Expert

No, Continue Reading

Testimonials

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Trusted by Leading Organizations

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

Recognized by

Leading Analysts & Platforms

Recognized by

Leading Analysts & Platforms

Recognized by

Leading Analysts & Platforms

Recognized by

Leading Analysts & Platforms

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Testimonials

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Testimonials

Trusted by Leading Organizations

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

Trusted by Leading Organizations

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

Trusted by Leading Organizations

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

Migrated from siloed internal tools to a unified fraud intelligence platform

Enabled real-time fraud risk monitoring across millions of orders using unified device, behavioral, and transactional intelligence.

Detected and disrupted fraud rings involving courier–customer collusion, promo abuse, and stolen card transactions.

Improved investigation speed and visibility with connected device and transaction insights that revealed hidden patterns.

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Testimonials

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Testimonials

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Testimonials

As we scaled Mrsool across cities and categories, fraud risks became more complex. Bureau’s unified device, behavioral, and transactional intelligence gave us real-time visibility into hidden patterns like collusion and card abuse—helping us act faster and protect trust without impacting customer experience.

Hamza Hashmi,

Head of Pricing & Risk

MRSOOL

Bureau enables us to meet SAMA’s strict fraud and device intelligence requirements without slowing down our customers. The platform gives us precise control over fraud rules, real-time detection across key journeys, and the ability to act instantly—keeping us compliant, secure, and agile as we scale

Ryan,

Risk Manager

Tweeq

Testimonials

Solutions

Resources

© 2026 Bureau . All rights reserved.

Solutions

Solutions

Industries

Industries

Resources

Resources

Company

Company

Solutions

Solutions

Industries

Industries

Resources

Resources

Company

Company

© 2025 Bureau . All rights reserved. Privacy Policy. Terms of Service.

© 2025 Bureau . All rights reserved.

Privacy Policy. Terms of Service.

Follow Us

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence

Leave behind fragmented tools. Stop fraud rings, cut false declines, and deliver secure digital journeys at scale

Our Presence